Image Sportivo Internationale offer a wide range of Tax & Investment services.

Contact ISI today for details on services pertaining to unique and individual circumstances.

Image rights are so much a part of global business. Sports people cannot ignore the fiscal responsibility these assets impose. Combining marketing, legal and tax strategies effectively, businesses will be able to improve results.

Taxation is a key driver in transactions involving intangible assets and, while there are certain pitfalls to be avoided, there are also many opportunities for groups to enhance their cash flow and maximise the financial return on image rights.

Aside from the usual legal and commercial considerations, there are a number of important tax issues to be considered, such as;

- Centralizing the ownership of intangible assets in the one holder vehicle.

- Where to locate that holding vehicle, taking into account the country’s corporate income tax and treaty network.

- Does the treaty network provide for substantial withholding tax reductions on cross border royalty payments.

- Have transfer pricing rules been considered.

- How to deal with capital gains tax issues in cases of migration to another country, disposal or as part of a business sale.

- Tax incentives for research and development activities.

The investment world is complex and ever changing. We believe an investment portfolio needs to be constantly and professionally analysed to ensure not only that it is appropriate for your current needs, but also that it takes into account future requirements. We direct our experience and knowledge to the benefit of our clients in plain language, and within cost effective structures.

We sell our advice and experience. We do not sell complicated financial product. We embrace financial innovation that allows us to enhance returns and identify/control risk in a transparent and cost-efficient manner.

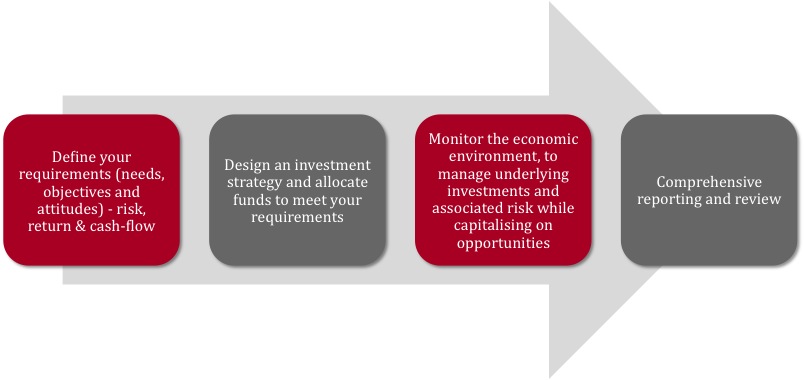

Whilst every client has differing needs and objectives, we regularly take each client through the process highlighted below to ensure we are meeting their requirements.

We have considerable experience managing investment portfolios for expatriates. Working in conjunction with your other professional advisers, we can provide you with advice on the following investment classes:

Our major focus is on managing portfolios of Australian equities and global equities to provide capital growth and growing income streams over the medium to long term. We construct portfolios using a combination of direct equities and exchange traded funds.

For clients who wish to be more active we also employ exchange traded option strategies to boost returns and manage risk.

Depending on the risk profile of each individual client, we may recommend a selection of ASX listed preference shares or hybrid securities, corporate or government bonds as well as traditional term deposits.

The aim of these investments is to provide capital stability and competitive income returns.

Your investment portfolio will need to have a linked bank account where income will be credited and transactions settled from.

We use bank accounts from a range of Australian institutions.

The team at Direct Property Advocacy will put your legal, financial, and real estate experience, knowledge and attention to detail with the objective ob achieving the maximum return on your investment and the advice to set up and manage your portfolio successfully.

We know that when dealing in property, pressure and uncertainty can lead to costly mistakes, which is why friendly, independent, honest and objective advice is critical. It’s a time and effort-intensive task that is often difficult to juggle with other frequently conflicting professional and private priorities. You save time when you work with us, because you only see properties that meet your criteria. We source and research relevant properties in the market place, to produce the optimum outcome for you.

Properties are sourced through our extensive network of contacts within the real estate industry and privately. Our contacts and experience allow them a unique level of access to many ‘silent’ purchases. These are properties purchased where there is no ‘for sale’ board, nor has an advertisement been placed; and often only our clients will ever see the home.

Direct Property Advocates are experienced in assisting expatriates returning to Australia to purchase a new home. As well, we can help non-Australian residents to purchase property and meet Foreign Investment Review Board guidelines. We also have an extensive international network and source property globally for many of our existing clients looking to invest or work abroad.

By working with you to understand and establish your specific requirements, we save you time and money with all your property transactions. We know what the property market is doing and make informed decisions.

Visit the website for more information www.directpropertyadvocacy.com.au

We offer the opportunity to facilitate the following risk management strategies including:

- Life insurance.

- Income Continuance.

- Trauma/Disability Insurance.

- Landlords Insurance.

- Fire, Theft, Public Liability.

- Storm, Malicious Damage.

- Loss of Rent.

Liase with a solicitor to review

- Wills.

- Estate Planning.

- Business Succession Planning.